PDF editing your way

Complete or edit your i 765 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form i 765 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form i 765 application employment authorization as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your i'765 form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form I-765

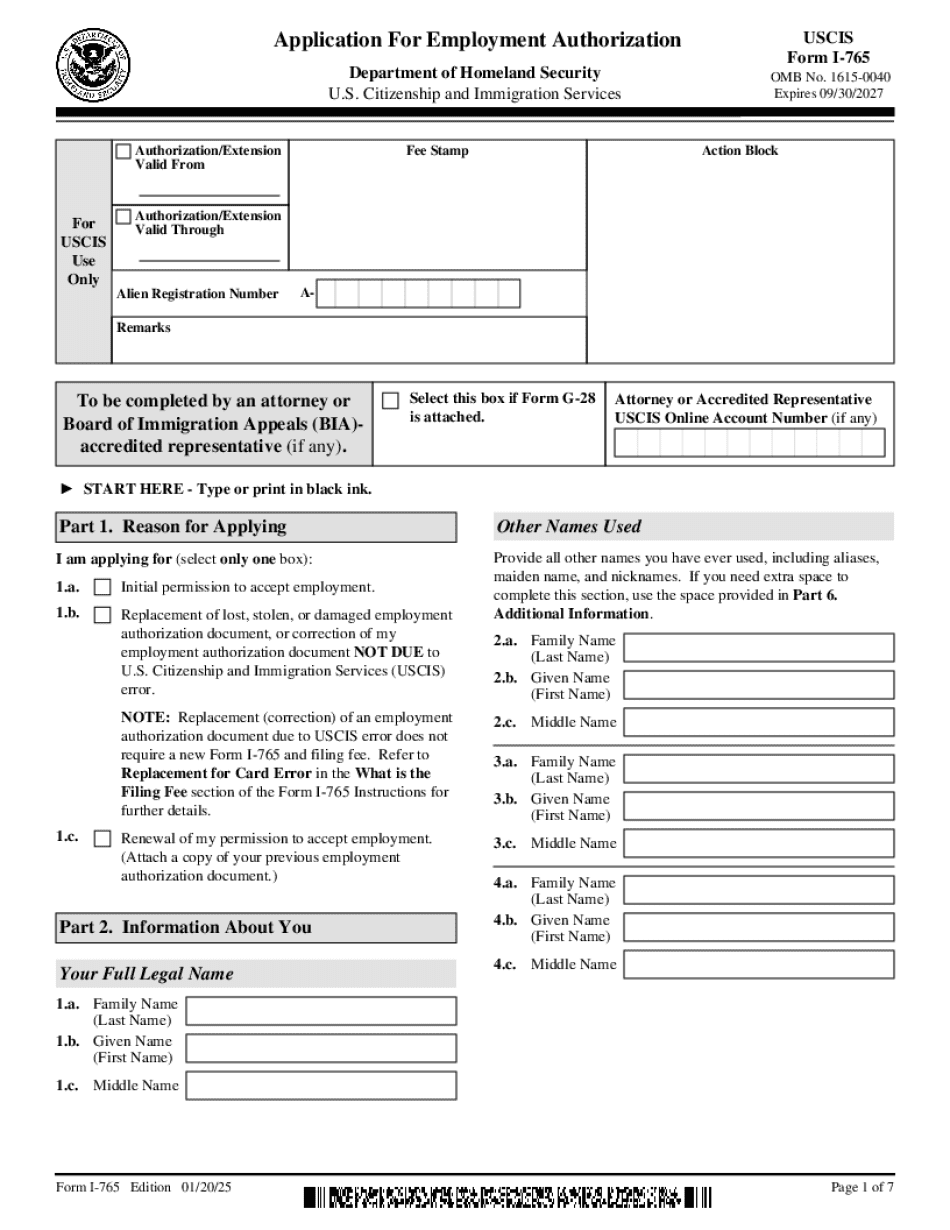

About Form I-765

Form I-765, also known as the Application for Employment Authorization, is a document issued by the U.S. Citizenship and Immigration Services (USCIS). It is used to request an Employment Authorization Document (EAD), which serves as proof that an individual is authorized to work legally in the United States for a specific duration of time. This application is typically required for certain non-U.S. citizens who are seeking employment eligibility in the country. The following categories of individuals may need to file Form I-765: 1. F-1 students: International students enrolled in academic or language training programs who want to work off-campus or participate in Optional Practical Training (OPT) programs during or after completing their studies. 2. J-2 dependents: Dependents of J-1 exchange visitors who hold an approved J-2 status. This allows them to apply for work authorization to support their financial needs. 3. Asylum seekers: Individuals who have filed for asylum or have been granted asylum in the United States and need to obtain an EAD to work legally. 4. Foreign nationals with temporary protected status: Individuals who come from countries facing temporary emergencies, such as natural disasters or armed conflicts, and have been granted temporary protected status in the United States. They need to file Form I-765 to obtain employment authorization. 5. Deferred Action for Childhood Arrivals (DACA) recipients: Individuals who were brought to the United States as children without proper documentation and have been granted DACA status by USCIS. They can apply for an EAD using Form I-765. 6. Spouses of certain visa holders: Dependents of E-1/E-2 treaty traders, L-1 intracompany transferees, or E-3 Australian specialty occupation workers are eligible for employment authorization and need to submit Form I-765. It is important to note that eligibility criteria and supporting documents may vary based on individual circumstances and visa classifications. Therefore, it is advisable to carefully review the USCIS instructions and consult an immigration attorney, if necessary, to ensure the correct completion of Form I-765.

What Is Form I 765?

Thousands of foreign workers come to the United States looking for better job opportunities. But before they actually get employed they must go through a tedious procedure to confirm their status.

According to the U.S. laws an employer isn’t allowed to hire people without work permit referred to as Employment Authorization Document. With this document an individual can prove that they are allowed to be hired in US and work there for some period.

The right way to get this permission is to complete Application For Employment Authorization.

However, not every person who comes to US is eligible to get EAD card.

Who may file the application?

There are some criteria that identify whether an individual must apply for EAD. They’re as follows:

-

Immigration status. All refugees, asylees, students from abroad and U nonimmigrants must get legal confirmation for their employment.

-

EAD renewal. A person is allowed to get a new card if the previous one is about to expire or has already expired.

-

Replacement process. If the card was stolen, lost or contains inconsistent information its owner can get the new one.

There is no need to file Form I-765 if an individual is a green card holder or has been invited to the US to work for a specific company.

How to fill out the application?

First, get the sample in PDF format. You can download it from the USCIS website or complete it online straight from our resource. The copy is printable so you can have a paper version, if you’d like. There are only two pages with 19 questions. Answer the questions entering accurate data into fillable fields. The minimum data that must be provided is filer’s name, SSN, place of birth, country of citizenship, the date of the last entry to US territory, etc.

Additionally you may be asked to complete the Worksheet. It aims to define whether a person has an economic background to work in US. It’s only one page long and is divided into three parts. The first part is for personal data, the second one requires financial info, the third part is designed for explanations.

You must also attach nonimmigrant record if any and two identical photos.

Follow the detailed instructions to properly complete all fields.

Where to file the document?

Make sure that you’ve correctly completed all sections. Then send the final version to the USCIS. The processing time depends on what category the filer’s case belongs to. For the cases other than asylees the procedure will take 30 days while the asylees will have to wait 90 days before USCIS announces its decision.

There is also filing fee that you will have to send with your template and biometric payment withdrawn from all individuals between ages 14 and 79.

If done everything right, you will soon be able to find a good job in U.S.

Save time filling out the forms you need straight from our platform. You can also collaborate on any document, get it signed or filled by others in a few clicks.

Online choices assist you to organize your document administration and increase the productivity of one's workflow. Stick to the fast tutorial for you to finish Form I-765, avoid mistakes and furnish it inside of a timely manner:

How to finish a I 765 Form?

- On the web site together with the variety, click on Get started Now and pass towards editor.

- Use the clues to complete the applicable fields.

- Include your personal information and make contact with knowledge.

- Make certainly you enter appropriate details and figures in suitable fields.

- Carefully test the subject material of your variety in addition as grammar and spelling.

- Refer that can help section when you've got any thoughts or tackle our Support team.

- Put an electronic signature on your own Form I-765 using the assistance of Signal Software.

- Once the form is done, push Executed.

- Distribute the ready variety through electronic mail or fax, print it out or conserve with your device.

PDF editor will allow you to make variations on your Form I-765 from any web related machine, customize it based on your requirements, indicator it electronically and distribute in numerous techniques.